Inheritance Tax Limits 2025 - How Much Is Inheritance Tax 2025 Usa Lenka Nicolea, Most families will not find themselves subject to estate tax when the value of their home is included because the current federal estate tax is only applicable to. Check if an estate qualifies for the inheritance tax residence nil rate band. Understanding the Estate Tax Retirement Watch, As of the spring budget 2025, the inheritance tax threshold remains unchanged at £325,000 per individual, with the tax rate for estates exceeding this amount set at 40%. Inheritance tax may have to be paid after your death on.

How Much Is Inheritance Tax 2025 Usa Lenka Nicolea, Most families will not find themselves subject to estate tax when the value of their home is included because the current federal estate tax is only applicable to. Check if an estate qualifies for the inheritance tax residence nil rate band.

An inheritance tax is levied on the value of the inheritance received by the beneficiary, and.

Estate and Inheritance Taxes Urban Institute, Generally, the value of the inherited assets. Actionable ways to reduce your inheritance tax bill so you keep more of the assets passed down to you

Tax Free Inheritance Limit 2025 Kacey Juliette, Inheritance tax thresholds — from 18 march 1986 to 5 april 2028. The limit for chargeable trust property is increased from £150,000 to £250,000.

Removal of the highest slab of 42.7% and restricting the same.

Inheritance Tax Colorado 2025 Alena, Check if an estate qualifies for the inheritance tax residence nil rate band. By giving away assets while.

This is going to be the first budget. If the value of the assets being transferred is higher than the federal estate tax exemption (which is $13.61 million for tax year 2025 and $12.92 million for tax year 2025), the property can be.

15 Ways to Avoid Inheritance Tax in 2025 YouTube, For the 2022 tax year, the annual gift limit is $16,000, and you can give up to $12.6 million over your lifetime without being taxed on it. The year 2025 brings about notable changes to inheritance tax and estate planning that warrant careful consideration for effective tax planning.

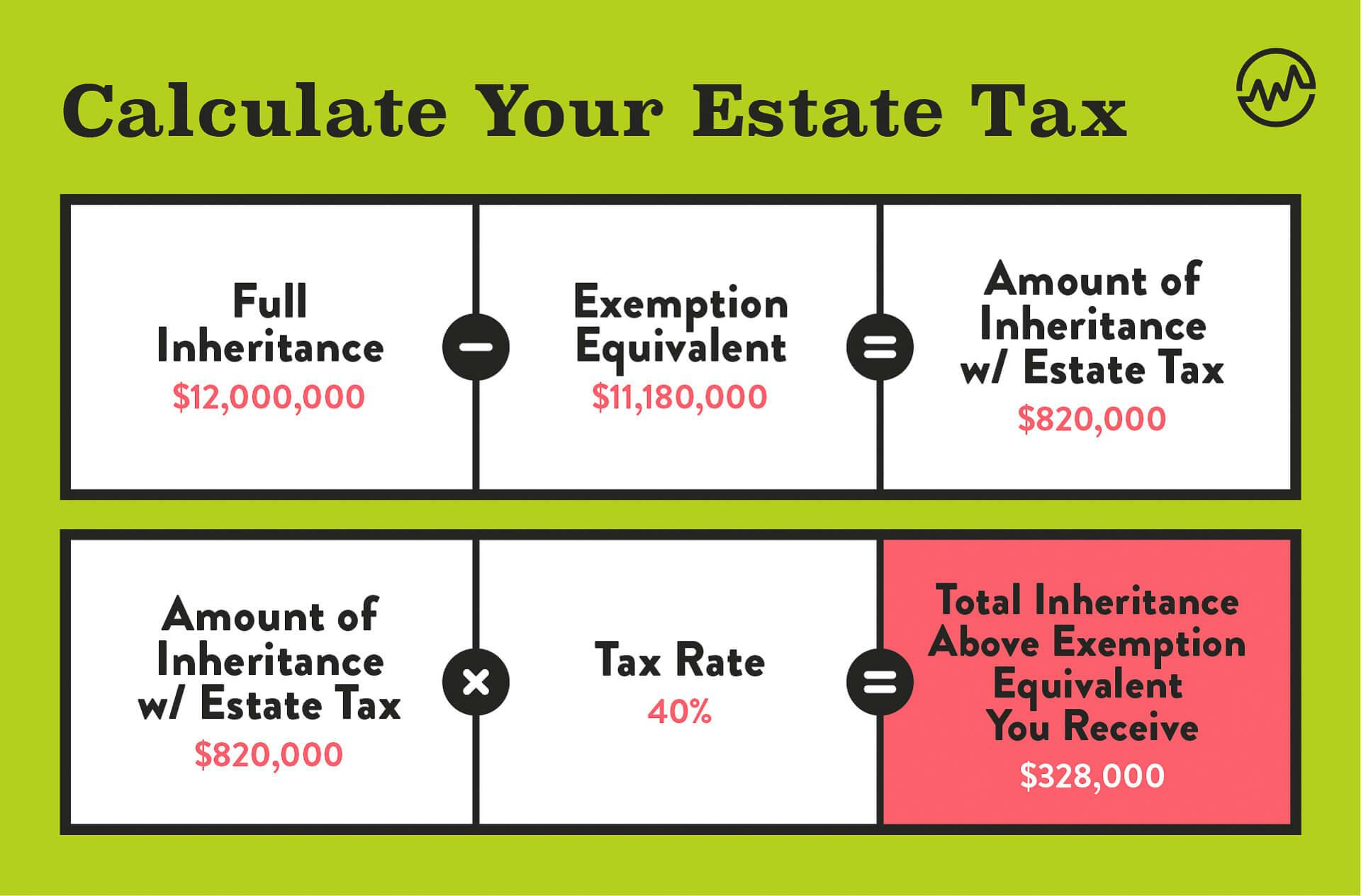

Weekly Map Inheritance and Estate Tax Rates and Exemptions, Federal tax rates range between 18% and 40%, depending on the amount above the $12.92 million threshold, or exemption amount, per person in 2025 or $13.61. For 2025, the federal estate tax threshold is $13.61 million for individuals, which means married couples don’t have to pay estate if their estate is worth $27.22.

2025 Federal Gift Tax Limit Julie Berenice, The standard inheritance tax rate is 40% of. By giving away assets while.

Most families will not find themselves subject to estate tax when the value of their home is included because the current federal estate tax is only applicable to.

Inheritance Tax Limits 2025. In the spring budget on 6 march. As of the spring budget 2025, the inheritance tax threshold remains unchanged at £325,000 per individual, with the tax rate for estates exceeding this amount set at 40%.

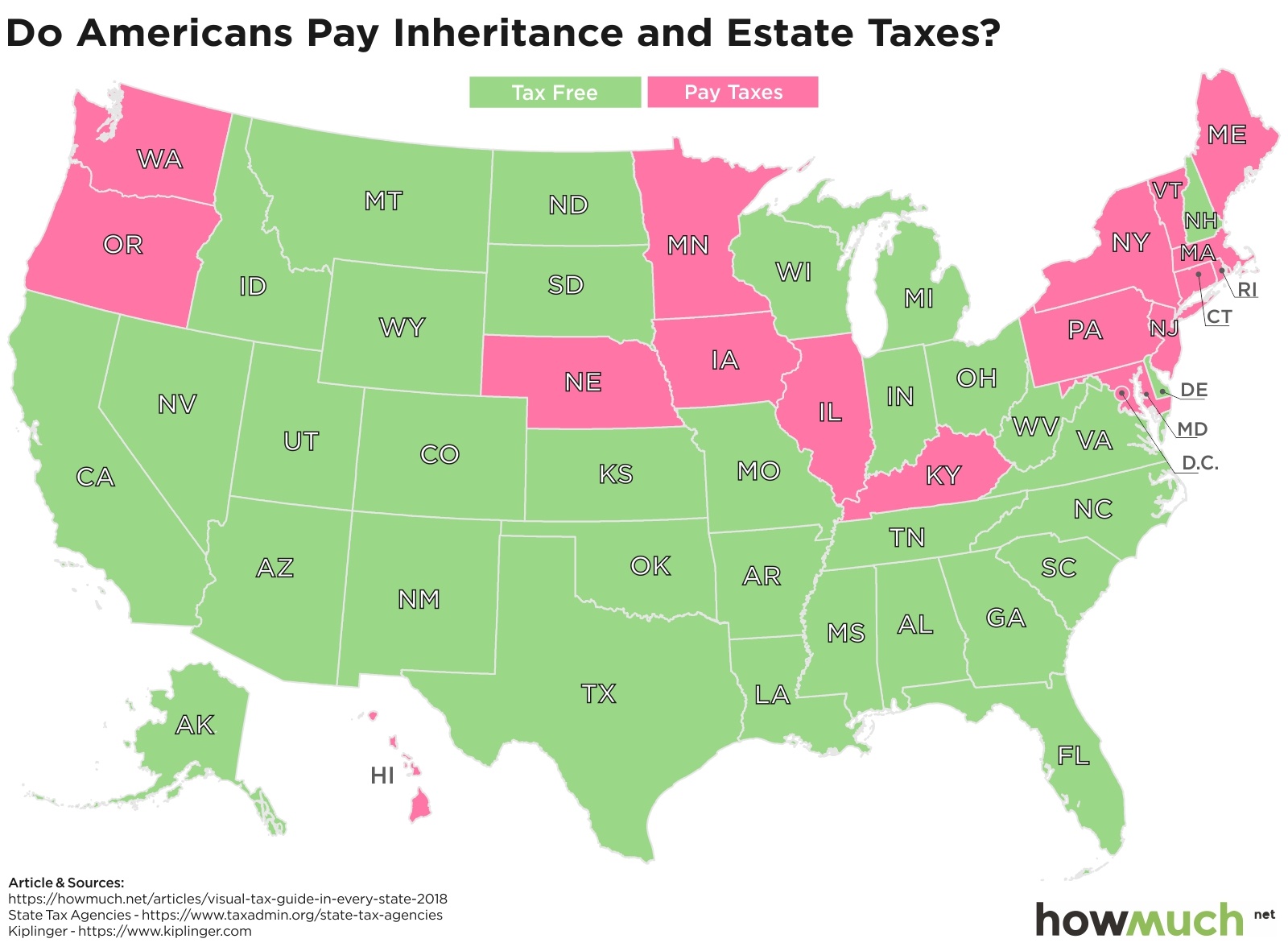

States With Inheritance Tax 2025 Kippy Merrill, By giving away assets while. Check if an estate qualifies for the inheritance tax residence nil rate band.

Inheritance Tax in UK, Most families will not find themselves subject to estate tax when the value of their home is included because the current federal estate tax is only applicable to. Iowa, kentucky, maryland, nebraska, new jersey, and pennsylvania.