Ira Contribution Limits 2025 - 2025 Roth Ira Contribution Limits Kylen Krystyna, Ira contribution limit increased for 2025. Your personal roth ira contribution limit, or eligibility to. For those aged 50 and older, the limit is $8,000, which includes an.

2025 Roth Ira Contribution Limits Kylen Krystyna, Ira contribution limit increased for 2025. Your personal roth ira contribution limit, or eligibility to.

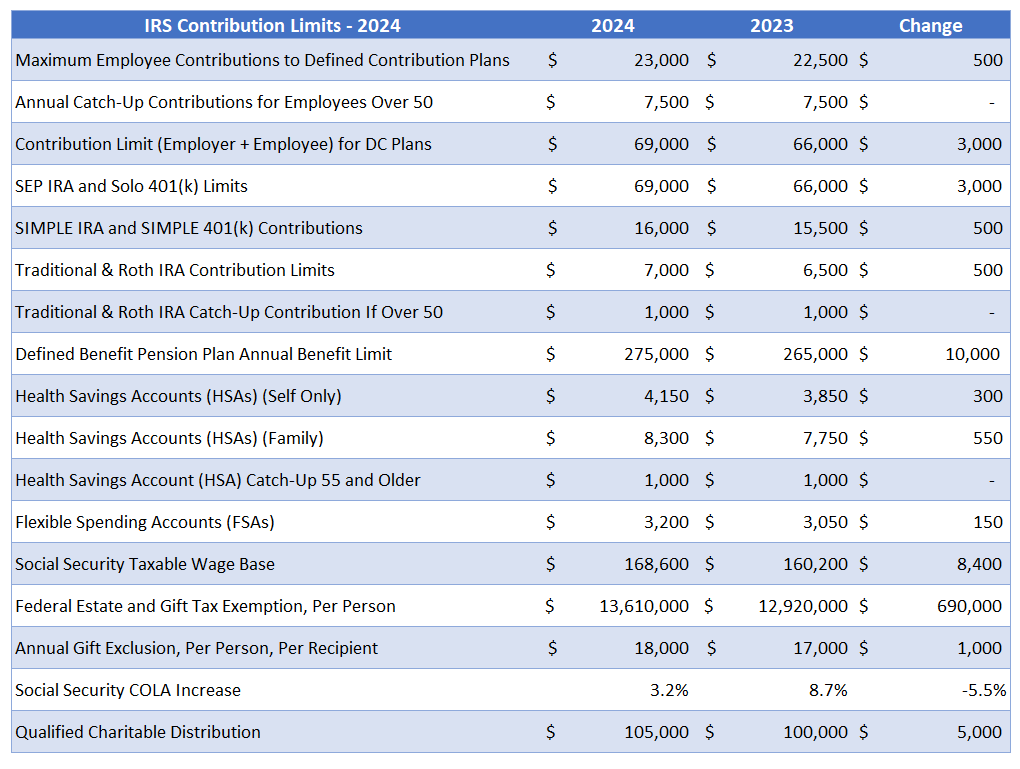

Ira Contribution Limits 2025 Deadline Dates Heda Rachel, Check out the new ira contribution limits and roth ira income limits below, and see just how much more you can save for retirement in 2025 with your iras. Contribution limits for simple 401 (k)s in 2025 is $16,000 (from.

Simple Ira Contribution Limits 2025 Irs Elisha Chelsea, The maximum total annual contribution for all your iras (traditional and roth) combined is: Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from $6,500 ($7,500 for.

What Are The Ira Limits For 2025 Margo Sarette, The 2025 roth ira income limits are less than $161,000 for single tax filers and less than $240,000 for those married filing jointly. The annual contribution limit for a traditional ira in 2025 was $6,500 or your taxable.

Ira Contribution Limits 2025. In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans. For those aged 50 and older, the limit is $8,000, which includes an.

Your personal roth ira contribution limit, or eligibility to. For 2025, you can contribute up to $7,000 if you are under 50, and up to $8,000 if you are older.

IRA Contribution Limits 2025 Finance Strategists, The maximum total annual contribution for all your iras combined is: Information about ira contribution limits.

2025 ira contribution limits Inflation Protection, As a couple, you can contribute a combined total of $14,000 (if you're both under 50) or $16,000 (if you're both 50 or older) to a traditional ira for 2025. For those aged 50 and older, the limit is $8,000, which includes an.

Roth Ira Limits 2025 Irs, What are the ira contribution limits for 2025? Ira contribution limit increased for 2025.

2025 IRA Maximum Contribution Limits YouTube, The 2025 contribution limits for traditional and roth ira contributions are $7,000 for individuals under 50 and $8,000 for those who are 50 or older. The maximum total annual contribution for all your iras (traditional and roth) combined is:

401k Roth Ira Contribution Limits 2025 Clio Melody, Ira contribution limit increased for 2025. The maximum total annual contribution for all your iras (traditional and roth) combined is:

You can make contributions up until april 15, 2025.

In 2025, individuals under age 50 can contribute up to $23,000 to traditional and roth 401 (k) plans.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based on your income. The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025.

For 2025, the maximum contribution limit for a roth ira is $7,000 for individuals under the age of 50.